You can use a variety of investment strategies to help achieve your retirement goals. The following case study provides an example.

Case study: Making the transition to retirement

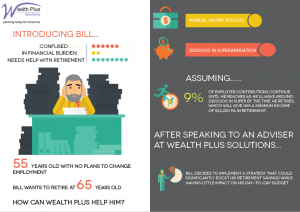

Bill is 55 years old and is currently working full time with no plans to change his employment arrangements. He wants to retire at 65. He has an annual salary of $50,000 and $300,000 in super. Assuming his 9% employer super contributions continue until he reaches 65, he’ll have around $300,000 in super by the time he retires, which will give him a minimum income of $24,220 pa in retirement.

After speaking to his financial adviser, Bill decides to implement a strategy that could significantly boost his retirement savings while having little impact on his day-to-day budget. He uses his $300,000 super balance to start a pre-retirement pension, drawing down the minimum payment allowed which is $12,000 a year. This gives Bill more income than he needs, so he arranges with his employer to make additional contributions to his super from his pre-tax salary under a salary sacrifice arrangement. His adviser works out exactly how much he needs to contribute to super through salary sacrifice so that his after-tax income is unchanged.

Even though Bill is still receiving the same amount of after-tax income as before, by implementing this transition to retirement strategy, he is able to increase her super balance rather than reducing it, helping him build valuable additional retirement savings.

By using this strategy, Bill could end up with approximately $45,000 extra in his super fund by the time she turns 65. These extra funds could increase his minimum retirement income to around $26,460 pa.

Notes

Source: Colonial First State. Assumptions: Earning 7.7% pa after fees and before taxes with inflation at 3%.Using 2012–13 income tax rates. Pension is paid as an allocated pension. Superannuation guarantee contributions are 9% of gross salary before any salary sacrifice. All superannuation contributions and pension payments are made regularly throughout the year. A change to any of the assumptions and variables can provide significantly different results. This case study is for illustrative purposes only. Your clients’ circumstances have not been taken into account.

Disclaimer

These case studies are for illustrative purposes only. They are not to be taken as personal advice and are intended to provide general information only. They do not take into account your individual needs, objectives or personal circumstances. The information is based on Financial Wisdom Limited’s understanding of the relevant Australian laws at 17 November 2011. You should assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision. Past performance is no indication of future performance. Financial Wisdom Limited ABN 70 006 646 108, AFSL 231138.

This web page has been prepared by Financial Wisdom Limited ABN 70 006 646 108, AFSL 231138, (Financial Wisdom) a wholly-owned, non-guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124. Financial Wisdom advisers are authorised representatives of Financial Wisdom.

Information in this web page is based on regulatory requirements and laws, which may be subject to change. While care has been taken in the preparation of this document, no liability is accepted by Financial Wisdom, its related entities, agents and employees for any loss arising from reliance on this document.

Sound advice is the key to success

As you can see from these case studies, the right type of investment and an effective financial strategy could make all the difference to achieving the lifestyle you want in retirement. Wealth Plus Solutions Pty Ltd offers knowledge, expertise and experience. We’ll take the time to understand your individual circumstances and retirement goals, then recommend appropriate strategies to help you achieve those goals.

To find out how we can help you plan a successful retirement, call 08 9368 4911 or email us.

This web page may contain general advice. It does not take account of your individual objectives, financial situation or needs. You should consider talking to a financial adviser before making a financial decision.